Beyond the Policy: Understanding Your Home Insurance Coverage and Common Gaps

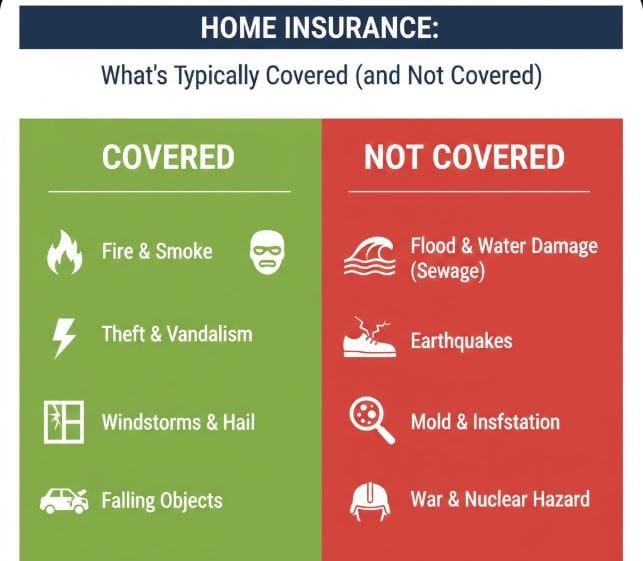

Homeowners insurance feels straightforward—until you file a claim and discover gaps you never knew existed. A standard policy protects against many sudden losses, but it’s full of limits, sub-limits, and exclusions that can leave you underinsured at the worst possible moment. Moving beyond the basics empowers you to spot those vulnerabilities and have more productive conversations with your agent.

Call Now for Affordable, Reliable Home Insurance Coverage

Most U.S. homeowners carry an HO-3 policy, which covers the dwelling, other structures, personal property, loss of use (additional living expenses), personal liability, and medical payments to others. The real differences lie in how those coverages pay out and where they stop.

Actual Cash Value vs. Replacement Cost: The Depreciation Difference

The single biggest decision affecting your payout is whether coverage is on an actual cash value (ACV) or replacement cost value (RCV) basis.

- Actual Cash Value (ACV) pays what the damaged or stolen item is worth today, after subtracting depreciation for age and wear. A 12-year-old hardwood floor might receive only 30–40% of replacement cost.

- Replacement Cost Value (RCV) reimburses the current cost to repair or replace with new materials of like kind and quality—no depreciation deducted.

Real-world example: Hail damages your 7-year-old roof. ACV might pay $8,000 (depreciated value), while RCV could pay $18,000–$22,000 for a new roof. Many policies automatically provide RCV for the dwelling but default to ACV for personal property (furniture, clothing, appliances). Upgrading contents to RCV usually requires a specific endorsement and may increase premiums modestly.

Ask your agent directly: “Is my personal property covered at replacement cost, or only actual cash value? If it’s ACV, what would the endorsement cost to change it?”

Frequently Overlooked Sub-Limits and Special Categories

Even when your total personal property limit looks sufficient ($75,000–$150,000 is common), the policy often caps recovery for certain items far below that amount.

- Jewelry, Watches, Fine Art, and Precious Metals

Theft coverage is typically limited to $1,000–$2,500 total (sometimes per item). A single stolen engagement ring or watch collection can easily exceed this.

Solution: “Schedule” or “float” valuable items under a personal articles endorsement or separate inland marine policy. Scheduled items are usually covered at an agreed value, often with no deductible and broader protection (including mysterious disappearance). - Electronics, Computers, and Home Office Equipment

Some carriers impose $1,500–$5,000 sub-limits on computers, TVs, gaming systems, and related gear—particularly for theft. Equipment used for business may be excluded or limited further. Remote workers with multiple monitors, laptops, and peripherals should verify coverage. - Water Backup, Sump Pump Failure, and Sewer Backup

Standard policies exclude surface flooding (lateral water entering from outside) and frequently limit or exclude backup through sewers, drains, or sump pump overflow.

Water backup is almost always an optional add-on with limits ranging from $5,000 to $25,000 (or higher with endorsements). Given that basement water claims rank among the most common and costly, many homeowners discover too late that they lack this protection.

Other typical sub-limits include:

- Firearms: $2,500–$5,000

- Silverware, goldware, pewter: $1,500–$2,500

- Money, coins, stamps, securities: $200–$500

- Trees, shrubs, lawns: $500–$1,000 per item, $5,000–$15,000 total

Check your declarations page for these caps and discuss raising them or adding separate coverage where your assets exceed the defaults.

How the Claims Process Really Works

Understanding the steps helps you avoid delays and underpayments.

- Right After the Loss

Prioritize safety, then prevent further damage (tarping a roof, shutting off water, etc.). Policies require “reasonable” mitigation efforts—failure to do so can reduce your payout. - Notification and Documentation

Report the claim promptly (most policies say “as soon as reasonably possible”). Photograph/video damage from multiple angles before cleanup. Keep receipts, serial numbers, and proof of ownership. - Adjuster Inspection

The insurer assigns an adjuster to evaluate damage and coverage. You can (and should):- Request a copy of their estimate

- Get competing bids from licensed contractors

- Ask for itemized explanations of any applied depreciation

- Settlement Payments

With RCV coverage, you often receive two checks:- Initial payment = actual cash value

- Supplemental payment = recoverable depreciation after repairs are completed (you must usually submit proof of completion)

Keep all receipts and invoices.

- When You Disagree

Provide additional evidence, request a re-inspection, or invoke the appraisal clause (each party selects an appraiser; they negotiate or use an umpire). Appraisal is binding and often faster than legal action.

Common denial or reduction reasons:

- Gradual damage / wear and tear

- Neglect or lack of maintenance

- Excluded events (flood, earthquake, war, nuclear hazard)

- Vacancy (coverage often drops or suspends after 30–60 unoccupied days)

- Intentional acts

Questions That Lead to Better Protection

Instead of asking vague questions, try these targeted ones:

- “Does my policy cover personal property at replacement cost value?”

- “What sub-limits apply to jewelry, electronics, firearms, and water backup?”

- “If my sump pump fails or the sewer backs up, what coverage and limit do I have?”

- “How does vacancy affect my policy if the home is empty for six weeks?”

- “Should I schedule any of my valuables, and what would that cost?”

Review your policy every renewal. Life changes—renovations, new high-value purchases, home-based business—can quickly outpace your existing coverage.Ensure your sanctuary is fully protected.

Call Now to Protect Your Home with Trusted Insurance Coverage